Account Monitoring Guide

A Note from Green Check

This document is intended to act as a job aid that helps reviewers understand the many functionalities of Green Check’s software and how it can benefit day-to-day operations. While the document details the functionalities of a comprehensive workflow as well as some real world scenarios, it is not intended to act as a policy or procedure. Account Reviews should be conducted depending on the unique risks posed by a specific business as well as the institution’s existing policies and procedures.

Create a New Review

New reviews are created automatically at a frequency determined by the Review Frequency set for each individual account. For a detailed walkthrough, please refer to this Support article. However, a review may be initiated at your team’s discretion at any point during the client lifecycle:

Select the Monitoring page using the navigation bar.

Input the selected timeframe. For the purposes of this document, we will be performing an annual review. In the data tab, you will have the chance to preview overall trends for active accounts. When you select the date range, you will see the list of accounts autofill below.

Click Create New Review.

This launches a pop up menu with multiple options. For financial institutions with large cannabis banking programs, there is a search function or the reviewer can simply select from the list. Select the Account, confirm the Review Length, and the Review Period. Depending on the length of the banking relationship, you will have some or all of the following options in Review Length: Weekly, Monthly, Quarterly, and Yearly. The Review Period options will vary depending on the previous selection. Once all options are selected, click Create. You will receive a message at the top of the screen that the request is being processed. For the purposes of this document, we will be reviewing a hypothetical retail business, Corkery’s Compassionate Health.

Once created, this review will be found in the Open Reviews tab found in the Monitoring page.

Beginning the Account Review

Navigate to the Open Reviews tab. The review will be listed with one of two statuses in blue: Processing or Start Review. If the status is still Processing, please wait a few minutes then refresh your browser. If the status is Start Review, feel free to proceed.

The Account Review section has five sections:

- Account Information

- Transaction Data

- Sales Activity

- Analysis

- Narrative and Conclusion

Tracking progress on the review is simple thanks to the progress bar at the top of the review. Additionally, to compare the client against predetermined Peer Groups, the reviewer can use the Compare dropdown. To read more about setting peer groups for your institution’s cannabis program, please see this Support article. For the purposes of this review, we will use the preset Dispensaries peer group.

The reviewer is able to make comments and send notifications to other reviewers on the team at any point throughout the review. The comments functionality is found in the lower right corner of the screen.

Account Information

The Account Information section will provide the reviewer with more information on the business along with the Green Check Timeline.

Basic client information such as the business name and business type is available upon first glance. Under it is information on the business’s license for easy and quick comparison. In the case of Corkery’s Compassionate Health, the reviewer would likely want to reach out to the client as they have identified their business type as “Retail” but they hold a “Producer” license. It could be that this is a user error, or perhaps the client converted their license and neglected to tell the institution. These discrepancies and any remediating activities are easy to track thanks to the Comments feature which allows the reviewer to communicate this to their team. Again, the External Comments feature is disabled during Account Monitoring so the reviewer will have to reach out to the client via email or phone.

Additionally, the Green Check Timeline allows the reviewer to keep track of vital upcoming dates in the client lifecycle. This includes the license expiration, upcoming quarterly SAR filings, application approvals, etc.

For Corkery's Compassionate Health, the reviewer is able to immediately identify that a SAR is overdue for this account. Consistent 90-Day regulatory reporting is a key component of compliant cannabis banking programs. The reviewer can use the Comments feature to communicate this with any team members who may have missed the notification that the deadline was coming up, or they can use the information being obtained via Account Monitoring to file the appropriate SAR themselves.

When the reviewer is ready to proceed, click the green Mark as Reviewed button. This will collapse the Account Information box and update the progress bar in the upper right corner.

Transaction Data

The Transaction Data section provides monthly views of six primary transaction types: Wire, Transfer, Physical, Card, Fee, and ACH. This may look different at your institution depending on how transactions are classified. Please see this article on managing transaction codes in the GCV Support Center.

The bubbles in the Transaction Timeline provide the reviewer with an easy comparison of debits and credits over the course of the month. Each dot represents aggregate transactions for a given day. To obtain a better understanding of certain days in particular, the reviewer can hover the mouse over each individual dot.

For the month of January, we can quickly deduce that the most frequent credits are coming from Physical transactions (cash and monetary instruments). This is what is generally seen in licensed marijuana retail businesses as the primary credit card companies (such as Visa and Mastercard) prohibit any transactions involving the purchase of product on their networks. The Card category in question refers to the business’s debit card issued by the depository institution for any non-marijuana related purchases. Please note that the account data being used throughout this document is testing data and frequent credits via Card would be an unlikely occurrence.

A comprehensive view of all debits and credits seen for the year per transaction type is found below in the Transaction Timeline. Should this information be insufficient for your institution’s purposes, or the reviewer would like to view a detailed summary via Microsoft Excel, please see the Reports tab located above Monitoring in the Menu bar. For more information on the types of reports available, please see this Support article.

In the case of Corkery's Compassionate Health, we can confirm that, while the majority of credits are the result of Physical transactions (47.9%), Card transactions (29.2%) make up a substantial portion of the business’s revenue. As stated previously, this is test data; however, this could become a real world scenario given the rapidly changing cannabis payments space. This would be something to discuss with the business and, while it may not be indicative of suspicious activity (especially if Corkery's Compassionate Health provides additional products and services outside of marijuana and how the account has been set up), clear communication is vital to serving and understanding this high risk industry. Additionally, the Comments function could be used to confirm with other team members who may be more familiar with the client whether or not these transactions are business as usual.

Click Mark as Reviewed to indicate that the section has been adequately assessed in accordance with all governing policies and procedures. This section will collapse and the progress bar will be updated.

Sales Activity

The Sales Activity section provides greater insight into the business’s operations by providing five sections: Daily Sales, Sales Summary, Payment Breakdown, Products Sold, and Customers.

Daily Sales provides a heat map so that the reviewer can derive an understanding of day-to-day foot traffic. From here, we can determine which day(s) and what time(s) of day are most popular and profitable for the business. This can enhance the institution's monitoring around the client as peak days in activity should correlate with deposits. Conversely, if there is a large increase in deposits but foot traffic remains constant, this could be an indicator of suspicious activity.

From the graphic above, it can be determined that Corkery's Compassionate Health derives most of its sales revenue via standard retail hours. However, it does appear that there are outlying transactions being conducted outside of these hours. It would be important at this time to confirm the business’s hours of operation. Sales conducted shortly after the close of business are often no cause for concern due to last minute customers, but transactions falling many hours outside of closing hours may warrant some additional follow up. Reminder, all data shown in this document is from Green Check Verified’s testing environment and is not necessarily what the reviewer will see in a live program – unless your institution is located in a state that allows for locations to be open 24 hours a day, it is unlikely that you will see transactions being conducted outside of most retail operating hours. However, if this was a real world scenario, the reviewer would likely want to take a sampling of daily transactions conducted during these time periods over the course of the year via the Daily Summaries tab located in the Dashboard feature. If it is the same employee conducting these transactions in each instance, this may be something to discuss with the business. Or the reviewer may want to check in regarding the business’s point of sale solution in case there may be any technical glitches.

The Sales Summary is an important measure of how well the business is conducting transactions in accordance with all state obligations. Green Check has three types of transactions:

- Verified sales are sales that satisfy all applicable state regulations.

- Unchecked sales are sales that are missing one (or more) data points used by Green Check’s Compliance Rules Engine to evaluate compliance. While the funds from these transactions can be deposited, it should be determined in the deposit institution’s policies and procedures as to how the compliance team should handle and investigate these funds.

- Unverified sales are sales that do not satisfy one or more applicable state regulations. These funds are not available for deposit. Similar to Unchecked sales, how these transactions are handled should be clearly defined in the deposit institution’s policies and procedures. While the funds will not be able to be deposited, frequent Unverified sales could be indicative of suspicious activity. For more information, please refer to this Support article.

From the Sales Summary above, the reviewer can confirm that the client is making a good faith effort to comply with state regulations surrounding the purchase of marijuana. While the reviewer should keep tabs on Unverified transactions, they are often the result of human error. However, how these transactions are reported or handled at the depository institution should be clearly defined in the governing policies and procedures.

By hovering the mouse over the Unverified portion of the Total Transactions bar, it can be confirmed that these transactions make up only 1% of total transactions for the entire year. While there has been an overall increase in the number of these transactions from the previous period, this is likely due to the increase in overall transactions. However, a sudden increase in unverified transactions might be indicative of a broken compliance process or the introduction of a marijuana product which is being improperly tracked by the point-of-sale system. Both hypothetical situations would warrant further investigation and conversations with the client.

Payment Breakdown provides an overview of how these transactions were conducted over the period specified. As Corkery's Compassionate Health has been identified as a retail location, the large amount of Cash is unsurprising. However, we do see that Debit card transactions make up a considerable portion of the transactions conducted throughout the year. Please note that the chart below shows all payment types regardless of verification status (i.e. verified and unverified).

As in previous sections, the mouse can be hovered over the chart for a granular view of the data. This provides confirmation that Debits account for over 30% of payments. While this may seem high for a retail location, the pop up shows that the amount of transactions is only slightly higher to that of its peer groups.

The Products Sold widget displays four categories of product. This is used primarily for the tracking of marijuana-derived products and tracks sales of Flower, Concentrate, and Edibles by Dollar Amounts, Units, and Weight. Products falling outside of this category fall under Other including, but not limited to: branded apparel, smoking paraphernalia, etc. It is important to note that these products are not run against Green Check’s compliance rules engine.

Considering that the Other category makes up nearly half of all sales at Corkery's Compassionate Health, this is where an understanding of the industry and the business’s operations becomes paramount. Generally speaking, dispensaries and retailers derive the majority of their revenue from the sale of marijuana -- not ancillary products such as rolling papers or branded products like t-shirts.

The Customers widget gives insight into individual customer trends such as how many unique visitors are visiting throughout the time period specified as well as their average sales and average transactions per customer. A significant increase in sales should align with either an increase in customers or sales per customer.

Click Mark as Reviewed to indicate that the section has been adequately assessed in accordance with all governing policies and procedures. This section will collapse and the progress bar will be updated.

Analysis

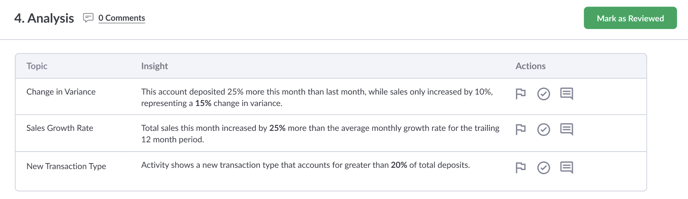

This section provides meaningful insights on where the business lies amongst its peer group. This allows the reviewer to quickly gauge whether or not the business is deviating from demonstrable industry trends. There are six areas to consider:

- Insights

- Transaction Analysis (Visualized),

- Transaction Summary

- Total Sales and Deposits

- Transaction Analysis (List)

- Account Activity

The first section lists any Insights that are generated based on this account's activity. Insights are plain English summary statements that describe the underlying data in an Account Monitoring review. They can serve as indicators of risk—like if an account is depositing much more each month than they are selling—and can act as tools to help you better understand and serve your cannabis customers.

Insights are generated based on your institution's thresholds, which can be configured in the Settings area. For more information, please refer to this Support article.

You can take the following actions on an Insight:

- Flag an Insight: This simply marks the Insight visually while you're looking further into it.

- Resolve an Insight: This allows you to add a note to resolve an Insight for tracking purposes.

- Comment on an Insight: This opens a comment thread, where you can mention other users for follow-up purposes and to track any related investigation.

Next, the Transaction Analysis visualization features a heatmap that examines transaction volumes via the six distinct transaction types we’ve seen in the previous sections. The volumes for the Current time period selected when first launching the review will be in green; volumes for the previous time period will be in blue. Given that we are performing an annual review, there may be many reasons why we are seeing an uptick in transactions – perhaps the business is expanding or the account was opened mid-way through the Previous Period. This is where the reviewer may want to refer back to the Green Check Timeline in the Account Information section to confirm when the account was approved. The reviewer can do this by simply scrolling up and clicking View Account Information to expand the section. They can also confirm by leaving a Comment for a team member you might be more familiar with the client.

The second heatmap imposes the same Current data over that of the business’s Peer Group. From here, it can quickly be confirmed that Corkery's Compassionate Health’s substantial growth is in keeping with overall industry trends.

Transaction Summary compares the business’s overall transactions to the Peer Group average for the time period being analyzed. It examines the data for Sales, Deposits, Deposits Average, Withdrawals, and Withdrawals Average. While it is clear that Corkery's Compassionate Health has increased overall sales substantially, the reviewer can confirm that these gains were also shared amongst their peers banking at the institution.

Total Sales and Deposits allows the reviewer to see how these transactions stack up, month-over-month using the six transaction types seen in previous sections: Sales, Wire, Transfer, Physical, Card, Fee, and ACH. The green line represents sales while the multi-colored bars represent deposits broken down by transaction type. In the case of Corkery's Compassionate Health, the various transactions remain consistent and follow the same, upward trajectory as overall sales. Instances where deposits exceed sales may warrant further review. Additionally, the reviewer is able to hover the cursor over any of the bars to reveal a breakdown of these deposits.

The Transaction Analysis (seen on the next page) builds upon the trends seen in Total Sales and Deposits by aggregating these overall figures by transaction type and comparing them with their peer group. From here, it is easy to deduce whether or not a given business is conducting transactions outside of industry standard (e.g. if substantial deposits are coming in via wire or if the majority withdrawals are made up of transfers to an account outside the financial institution). While Corkery's Compassionate Health ranks high in the 17th percentile in certain categories (Transfer In, Physical In, Transfer Out, and Ach Out), the business does not seem to deviate far from overall trends within their peer group. However, the reviewer may want to work with business or another member of their team to gain a better understanding of some of these figures and the reasoning behind how they are being transmitted.

The final item for review is Historic Account Activity. This box compares Deposits, Sales, and Withdrawals seen for the time period specified against the previous time period. Additionally it calculates the variance for each duration. While Corkery's Compassionate Health seems to have experienced remarkable growth in Sales and Deposits, it can be confirmed that the business has been seeing roughly the same amount of growth overall for the previous two years.

Click Mark as Reviewed to indicate that the section has been adequately assessed in accordance with all governing policies and procedures. This section will collapse and the progress bar will be updated.

Narrative and Conclusion

This is the final section of the Account Monitoring process. You made it!

The text box is dedicated to the reviewer’s findings. While the reviewer’s institution might have standardized verbiage for SAR filings or Account Reviews, Green Check assists with the narrative by providing a standardized template. This includes important information regarding the business itself as well as transaction data broken down by transaction type. Simply click Insert Template to auto-populate the Narrative box. This feature helps the reviewer streamline all quarterly Marijuana Limited SAR filings in addition to yearly or off-cycle client reviews.

The Risk Rating drop down below the text box allows the reviewer to assign a level of risk for the business and also re-evaluate if it has changed based on the current review. While the default is No Rating, the governing institution has the option of assigning risk levels to all marijuana-related businesses; however, it is important to document the methodology of determining the risk level in the policies and procedures. The ratings available in the drop down are: No Rating, Low, Low-Moderate, Moderate-High, and High.

Supporting Documentation allows the reviewer to upload any additional supporting documentation such as additional research or inquiries as part of this review. This can be left up to the discretion of the reviewer or whatever is required by the governing institution’s policies and procedures (e.g. Negative News searches).

Click Mark as Reviewed to indicate that the section has been adequately assessed and Narrative has been completed in accordance with all governing policies and procedures. This section will collapse and the progress bar will be updated. At this point, the completion bar should show 100% Complete. Click the green button at the bottom of the screen to Complete Review.

The Review will move into the Completed Reviews tab and a green message stating “Review completed successfully.” will be displayed.

Please note, Green Check saves your progress automatically so the Account Review does not have to be completed in one sitting. Additionally, the process can include other members of the review team. All completed reviews can be found in the Completed Reviews tab and the next review will be automatically triggered based on the Review Period assigned to the business.